Small Loans for Big Dreams

Financial instruments like micro- and nano-credit have the potential to change lives. But this potential is often curbed by several limitations. A primary constraint is that of the underlying ICT infrastructure. Without the right supportive technology, the efforts to reach out and uplift Ghana’s underserved will remain a dream on paper, when considering the inaccessibility of customers and the significant lending risks involved.

Express Credit for Express Needs

DCM’s Digital Lending Platform for Nano Credit seeks to overcome this barrier through an innovative combination of tools and technologies. This user-friendly platform helps Ghana’s financial institutions deliver instant collateral-free credit products digitally to Ghana’s financially underserved and typically unbanked population leveraging existing mobile money networks.

This handy platform enables registered mobile money subscribers to access digital financial services, helping them avail quick and easy credit in just a few clicks – irrespective of the mobile device they own. DCM extends this software to banks and MFIs in a Platform-as-a-Service model, allowing them to improve their reach and extend financial assistance at reduced risk.

Use the Power of ICT

- Reach out to remote customers digitally, reducing loan origination costs for credit providers

- Extend digital financial services to both smartphone and feature phone users

- Enhance risk mitigation and compliance obligations with accurate customer profiles

- Manage end-to-end credit cycle from loan origination to loan disbursement and collection.

- View dashboards and generate powerful reports

- Improve access to financial services and promote financial inclusion of Ghana’s underserved and typically unbanked population

About the Product

DCM’s Digital Lending Platform enables FIs to extend digital credit products in Ghana. Financial support is extended to Ghana’s underserved and typically unbanked population in the form of collateral-free micro and nano loans. The platform also enables end-to-end management of loan portfolios, from leveraging Artificial Intelligence/Machine Learning (AI/ML) to generate accurate customer profiles for issuing loans, tracking, reporting and communicating digitally.

Product Features:

- A user-friendly, network & device agnostic platform for FIs to reach customers leveraging ICT.

- Users can register easily, using just their name, national ID, and phone numbers. No extensive paperwork is needed.

- A truly integrated technology-enabled model allows lenders to optimise loan portfolio and lending cycles.

- A dynamic AI/ML engine generates customer profiles using predictive modeling, thereby reducing risks and bad loans.

- Advanced Customer Relationship Management platform and granular reporting capabilities allow lenders to issue, track loans and calculate charges, while leveraging improved data analytics to generate extensive reports, enabling FIs make better decisions.

Product Highlights

USSD Gateway

Feature phone and smartphone users can register, apply for loans, repay and do more using USSD gateway integrated with VASP and NCA short codes.

SMSC

On-time alerts can be sent to customers to notify them of loan offers, payment reminders, status and so on.

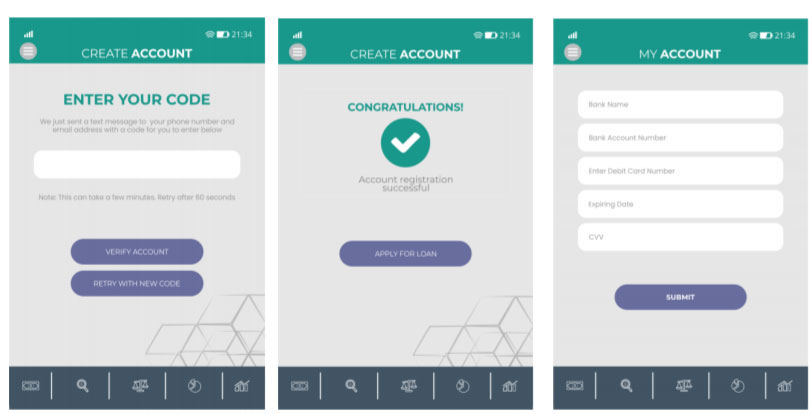

Mobile App

A custom-developed Android app helps customers manage their complete micro-loan interaction cycle with the bank or lender.

CRM Web & Portfolio Management

An internal web application helps banks and MFIs with the administration and management of loan provisioning cycles and related activities.

Loan Process & Portfolio Management

Manage the entire loan portfolio, from loan provisioning to disbursement, repayment and tracking

API integration with funding partner

Send customers loan requests, view credit score, loan amount, request loan disbursements and repayment.

API Integration with a bank

Integration with a local bank in Ghana to support Instant Pay services to handle instant loan disbursement and repayments between a mobile wallet and bank account.

Have a question?

Connect with us.